Issue IMO midterm measures to add 80% premium to bunker costs by 2035 says M…

페이지 정보

작성자 최고관리자 댓글 0건 조회 1,820회 작성일 25-05-08 13:54본문

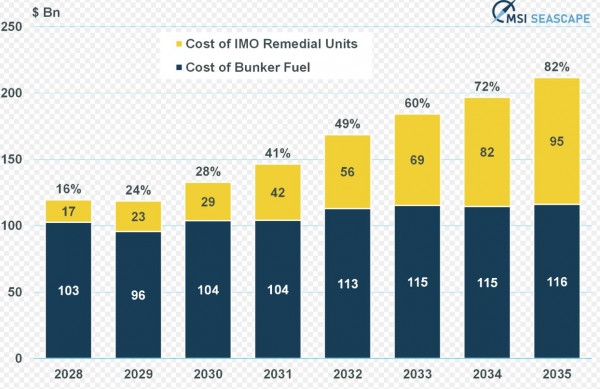

IMO midterm measures to add 80% premium to bunker costs by 2035 says MSI

Analysis using SEASCAPE platform shows that money raised could amount to $100bn annually for bunker fuel within the next decade

London and Singapore, 07 May 2025. Maritime Strategies International, a leading provider of maritime and energy research, consultancy and forecasting, has released MSI SEASCAPE, an integrated platform for market analysis, vessel performance and asset valuation.

Analysis performed by MSI using data from the new platform has given an early indication of the impact that the IMO’s recently agreed Net Zero Framework will have on the bunker market.

MSI SEASCAPE is designed to support two key functions: first, benchmarking the activity of existing fleets and vessels, and second, due diligence for acquisition, lending or chartering activities.

By extending the annual fuel consumption estimates calculated in SEASCAPE for 2024 through to 2035, and applying MSI’s forecasts for bunker prices, it is possible to project the future fuel costs for all conventionally-fuelled ships included in our SEASCAPE platform (just over 30,000 ships), alongside the projected IMO penalties.

This provides some indication of the scale: by this approach, the IMO’s penalties would be equivalent to an 82% premium on top of the fleet bunker costs by 2035 – almost $100 Bn for the ships included.

From another perspective, this also highlights the opportunity for the shipping bunker market – an annual pot directed towards drop-in biofuels and low carbon alternatives that could rise to $100 Bn per year within the next decade.

MSI SEASCAPE is designed to complement MSI products which offer a forward view of the market by providing a complete retrospective, 12-month view on the global fleet. Hourly data on vessel activity provides vessel speed, direction, emissions, fuel consumption, port time and anchorage durations.

In an innovative alternative to providing raw AIS data, MSI uses machine learning to identify changes in voyage patterns and ship clusters, developing an algorithm to measure vessel tracks, speed and port stays to generate emissions data where AIS satellite tracks were not available. Each month, MSI’s algorithm generates data for over two million ‘dark periods’ where AIS signals are absent.

The platform is designed to meet the needs of an increasingly diverse customer base which is seeking insights into global shipping activity, values and environmental performance.

Seascape segments into four principal data modules:

- Activity displays the historical operational profile by ship, its voyages, port calls, diversions, time at anchor, sanctions compliance etc.

- Green displays estimated emissions on both a Tank-to-Wake and Well-to-Wake basis and also provides AER and CII ratings for the vessel including the change over time and alignment with the Poseidon Principles.

- Value displays the current value of the asset using historical data from MSI’s Forecast Marine eValuator FMV tool.

- DCF uses a Discounted Cash Flow Model to determine whether the ship is over or underpriced vs the current market value, based on MSI’s expert-led forecasts for earnings and values extracted through its HORIZON forecasting model.

Users can extract data by ship, by fleet or sections of the global fleet, filtering by vessel type, characteristics or IMO number. The product is being made available at flexible subscription levels allowing users to start with the data they require most and add additional sectors as their needs evolve.

“MSI has invested two years in SEASCAPE’s development, driven by demand from customers for improved modelling of fleet behaviour at a time when fleet inefficiencies and diversions are impacting earnings and values far in excess of historical norms,” said Will Fray, Director, MSI. “The platform can also be used for due diligence prior to vessel acquisition/lending or charter, to track fleet or vessel behaviour and compare against cohorts and competitors.”

■ Contact: Maritime Strategies International(MSI) www.msiltd.com