Feature Story Is This a Good Time to Start Financing Panamax Bulkers?

페이지 정보

작성자 최고관리자 댓글 0건 조회 1,563회 작성일 25-05-20 12:55본문

Is This a Good Time to Start Financing Panamax Bulkers?

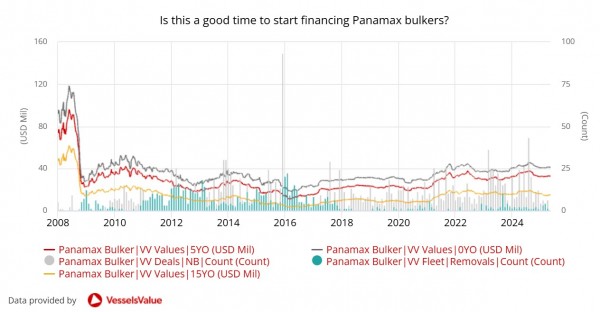

VesselsValue’s Timeseries product can be used to assess when may be a good time to start financing a specific vessel type. In this instance, we’ve taken a look at the Panamax sector and have compared newbuilding orders with demolition levels alongside trends in values.

Values for Panamaxes have moved lower across most sub sectors and age ranges from the same period last year. Values for older 15 YO vessels of 80,000 DWT have seen the biggest drop, down by c.18.14% year-on-year from the 14-year highs of 2024 of USD 18.14 mil down to USD 14.85 mil today. However, values for -3YO newbuild Panamaxes of 82,000 DWT have strengthened by c.4.87% year-on-year from USD 40.04 mil to USD 41.99 mil.

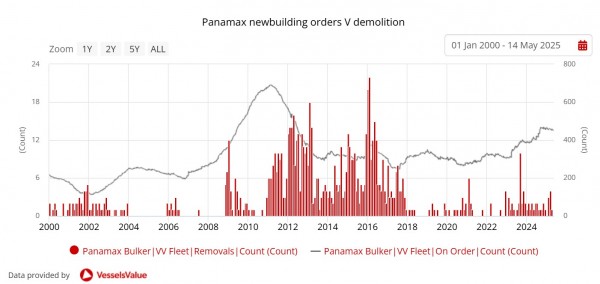

These value shifts are happening in a broader context of muted activity. Secondhand sales volumes for Panamaxes are down by c.13% from the same period last year where 98 Panamaxes changed hands, compared to 85 in 2025 to date. Newbuild orders have also taken a dramatic plunge of c.73% with just 19 orders placed so far this year.

Bulker earnings have moved lower from last year’s highs as many market players take a wait-and-see approach, holding off on major decisions until more information becomes available as the world awaits the outcome of the Geneva talks between the US and China. Panamax one year TC rates down year-on-year by c.29% to around 11,850 USD/Day. Demolition levels, while slightly higher than last year, remain very low as owners continue to operate their vessels to maximise earning capacity, even in a soft earnings environment. This suggests a reluctance to scrap ships, with many still trying to extract value from ageing fleets.

The Panamax sector, in particular, is characterised by an ageing fleet, with a significant portion approaching or exceeding 15 years of age. While there is potential capacity for demolition should market conditions shift, the current landscape points to inevitable fleet renewal in the medium term—creating an opportunity for investors focused on modern, efficient tonnage.

Notable recent sales include the Panamax BC Ivestos 6 (76,600 DWT, Apr 2006, Imabari) sold DD due to unknown Vietnamese buyers for USD 9 mil, VV Value USD 10.12 mil. Also the Panamax BC Sea Venus (80,900 DWT, Oct 2013, New Century) sold to undisclosed buyers for USD 16.7 mil, VV Value USD 16.57 mil.

The Panamax sector is showing some encouraging signs, particularly in newer vessels that have held their value or seen modest gains, while older ships have experienced some decline. Although activity in secondhand sales and newbuild orders has slowed, indicating a cautious market, low demolition rates, and consistent demand for modern tonnage points to potential in younger vessels.

As the market continues to shift, the stability of newer Panamaxes, along with a maturing global fleet and limited additions, makes them a reasonable option for those considering future investment.

■ Contact: Veson Nautical www.veson.com

- 이전글HD현대중공업 노사, ‘2025년 임금교섭’ 상견례 25.05.22

- 다음글ABB, 분산제어시스템(DCS) 컨트롤러에 대한 환경성적표지(EPD) 인증 취득 25.05.20