Feature Story Ageing fleet driving increase in incidents

페이지 정보

작성자 최고관리자 댓글 0건 조회 1,611회 작성일 25-06-15 20:45본문

Ageing fleet driving increase in incidents

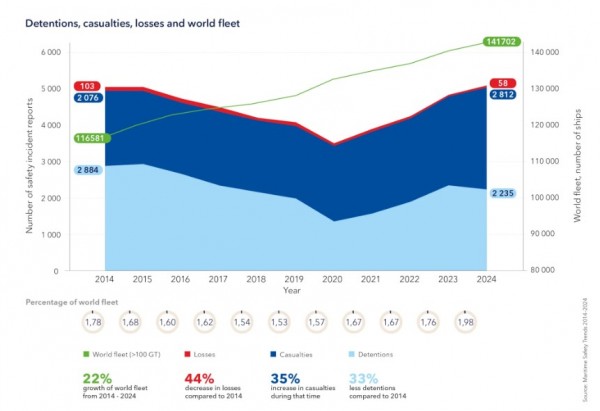

A clear uptick in casualties in 2024, driven by machinery damage/failure and an ageing fleet, stands out in the latest analysis of Lloyd’s List Intelligence casualty data.

The number of maritime casualties rose by 15% in 2024. Coupled with a 7% rise in casualties in 2023, this represents a concerning development for the maritime industry, particularly with the global fleet growing at a considerably slower rate.

This trend has now been established for several years. While the overall number of incidents declined by 5% between 2014 and 2018, the figure has increased every year since.

Between 2018 and 2024, the number of incidents increased by 42%. Over the same period, the number of vessels in the global fleet increased by 10%.

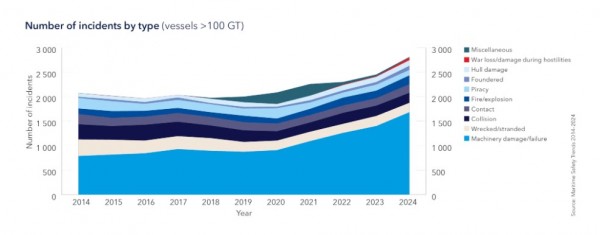

Casualty data, which is sourced from Lloyd’s List Intelligence, has been categorised under the following headings: collisions with another vessel, contact with a static object (e.g. harbour wall), fire/explosion, foundering (sunk or submerged), hull damage (hole, crack, or structural failure), machinery damage or failure (e.g. lost rudder, fouled propellor), piracy, war loss or damage during hostilities, and wrecked or stranded (aground).

Continuous increase in machinery failures boosts casualty rate

Machinery damage/failure has traditionally accounted for the largest portion of incidents. However, its share has increased significantly over the course of the past decade. In 2014, this accounted for 38% of all incidents but rose to 60% by 2024.

Machinery damage/failure is also the main driver of the sharp uptick in casualty numbers in 2024, accounting for 80% of incident growth.

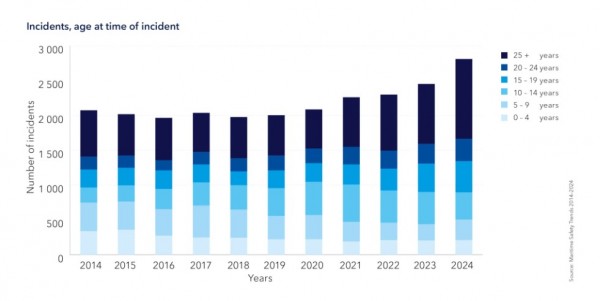

While the reasons for these kinds of casualties are wide and varied, some key figures stand out from the statistics. Top of the list is the ageing global fleet. In 2014, 36% of the global fleet was 25 years or older, with a further 7% in the 20-24 years age category. In 2024, 44% of the global fleet was over 25 years old, with 9% in the 20-24 years age category.

Factors driving the ageing fleet and delayed vessel scrapping

A range of different factors are contributing to the ageing fleet. In recent years, there has been high demand for tonnage, with this translating into sky-high freight rates, particularly in 2024. Many shipowners are delaying the scrapping of vessels that would normally be decommissioned, opting to profit from these assets instead.

Other factors that are also at play are the new regulations from the IMO and EU on emissions and fuel efficiency. These have made shipowners hesitant to invest in newbuilds until they are more certain about what new fuels to adopt. Additionally, space in shipyards is limited and building costs are high, driving shipowners to focus on their existing assets, or else upgrade or retrofit these assets instead of replacing them.

Either way, the ageing global fleet is clearly having an impact on casualty statistics.

Over half (52%) of all incidents in 2024 were attributable to vessels 20 years of age or older, with 41% of incidents for vessels in the 25+ age category. In contrast, 41% of incidents in 2014 came from vessels over 20 years old, with 32% coming from the 25+ age category.

The statistics also show that the growth in incidents in 2024 is mainly being driven by the older portion of the fleet. In real terms, the number of casualties rose by 358 between 2023 and 2024. Some 285 of these incidents came from vessels over 25 years old, representing 80% of all incident growth. Of these, 236 (83%) were attributable to machinery damage/failure.

For machinery damage/failures, age is an even bigger factor. In 2024, a total of 45% of these kinds came from vessels over 25 years of age, with a further 12% in the 20-24 age category. In 2014, the corresponding figures were 39% and 9%, respectively.

The ageing fleet is also a significant factor in the number of hull damages, which increased by 7% to reach 114 incidents in 2024. Some 46% of hull damages were attributable to vessels which were 20 years or older.

While the main way of reversing this trend will be a replacement of the ageing portion of the global fleet with new, modern vessels, some other short-term fixes can be applied. More regular maintenance of vessels, and upgrades to equipment and parts can reduce the risk of casualties for these vessels, helping to prolong their lifespans in a way that is safer for the vessels, their crew, and the surrounding environment.

Urgent need for better fire safety

Of equal concern are the numbers of fire/explosions, which increased by 18% in 2024, and by 58% since 2014. As fire and explosions tend to have higher rates of injuries and fatalities and, with a disproportionately high amount (27%) coming from the passenger/ferry segment, this is a trend that needs to be quickly reversed. As a matter of high priority, enhanced fire safety measures and emergency response training should be implemented on all vessels where this is deemed to be lacking.

Decline in collision, foundering, and piracy incidents but sharp increase in war losses

Putting these trends aside, the safety data does have some more promising stories to tell. Although the number of ‘accident’ casualties – a combination of collisions with another vessel, contact with a static object, foundering, and wrecked/stranded – slightly increased in 2024, the overall trend shows that this decreased from a total of 881 in 2014 to 656 in 2024, representing a decline of 26%.

This decline is likely attributable to technological advancements which have seen significant improvements to navigation systems, digital safety mechanisms, and route and weather planning over the past decade. Other factors, such as improved vessel design and engineering, stricter safety regulations, and data-driven risk management have also contributed.

Casualties involving piracy also fell in 2024, with the overall trend showing a 48% decline in these kinds of incidents between 2014 and 2024. This is largely the result of sustained international cooperation over the past decade, which has led to improved maritime security practices, regional stabilization efforts, and the adoption of best management practices by shipping companies.

In contrast, however, war loss incidents increased with yearly numbers ranging from zero to three until 2021 to 51 in 2024 due to ongoing political conflicts. This underscores the impact of geopolitical instability on maritime safety, highlighting the vulnerability of maritime operations in conflict zones and how this can lead to increased risks for vessels, cargo, and crew.

The rise in machinery-related casualties cuts across most vessel segments:

- General cargo ships accounted for 26% of all incidents, with a 13% increase in machinery failures in 2024.

- Passenger/ferry vessels saw a 48% jump in machinery failures and a 29% rise in total casualties, reaching 672.

- RoRo/PCTC segment incidents grew 69%, mainly due to an 87% spike in machinery issues.

- Bulk carriers saw modest incident growth (2% in 2024), though machinery issues fell 13%, countered by increased fire, hull, and piracy incidents.

- Container ships had only a 2% increase in incidents, with a 10% drop in machinery failures, though fires and collisions rose.

- Tankers were the only segment with a 3% decline in total incidents, despite an 11% rise in machinery issues.

- Gas carriers maintained the same number of incidents as 2023, with a 35% drop in machinery failures.

Shipowners and operators urged to take action to mitigate todays and future risks

While there are some glimmers of positivity, the overall trend in maritime safety is unmistakably negative. A steadily ageing fleet is clearly driving an increase in the number of incidents, and it is incumbent on shipowners to mitigate this issue through better maintenance, or other means.

The adoption of new technologies and fuels is also likely to be a growing factor in the years ahead and this should be addressed from an early stage though the implementation of safe vessel designs, profound technical barriers, best practices and comprehensive, continuous training for all crew members.

The maritime industry is in the middle of a period of great transformation. While this offers significant promise, it is also full of uncertainty, and stakeholders across the industry should continue to adopt best practices in ensuring the safety of vessels and crew.

■ Source: DNV www.dnv.com